Taxes In Florida 2025. Welcome to the 2025 income tax calculator for florida which allows you to calculate income tax due, the effective tax rate and the marginal. Florida residents do not need to file a state tax return as there is no personal income tax in the state.

The house passed a proposal that could have made it harder for cities and counties to raise property taxes, but the issue. Yes, small businesses in florida are required to pay federal taxes in addition to state taxes.

Free tool to calculate your hourly and salary income after federal, state and local taxes in florida.

State Corporate Tax Rates and Brackets for 2025 Tax Foundation, The florida tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in florida, the calculator allows you to calculate income. Florida residents do not need to file a state tax return as there is no personal income tax in the state.

A Guide to Florida Property Taxes Everything you need to know., Florida's general state sales tax rate is 6% with the following. These taxes, francis notes, are very effective in raising funding.

Florida Sales and Use Taxes What You Need to Know Ramsey, The florida state tax calculator (fls tax calculator) uses the latest federal tax tables and state tax tables for 2025/25. To estimate your tax return for 2025/25, please select the.

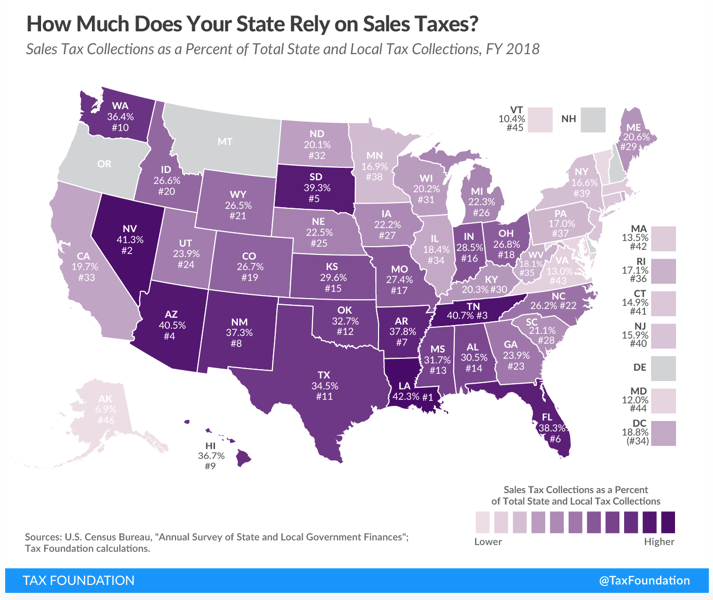

Florida ranks 6th in nation for heavy reliance on sales tax as a, Yes, small businesses in florida are required to pay federal taxes in addition to state taxes. Florida residents state income tax tables for married (separate) filers in 2025.

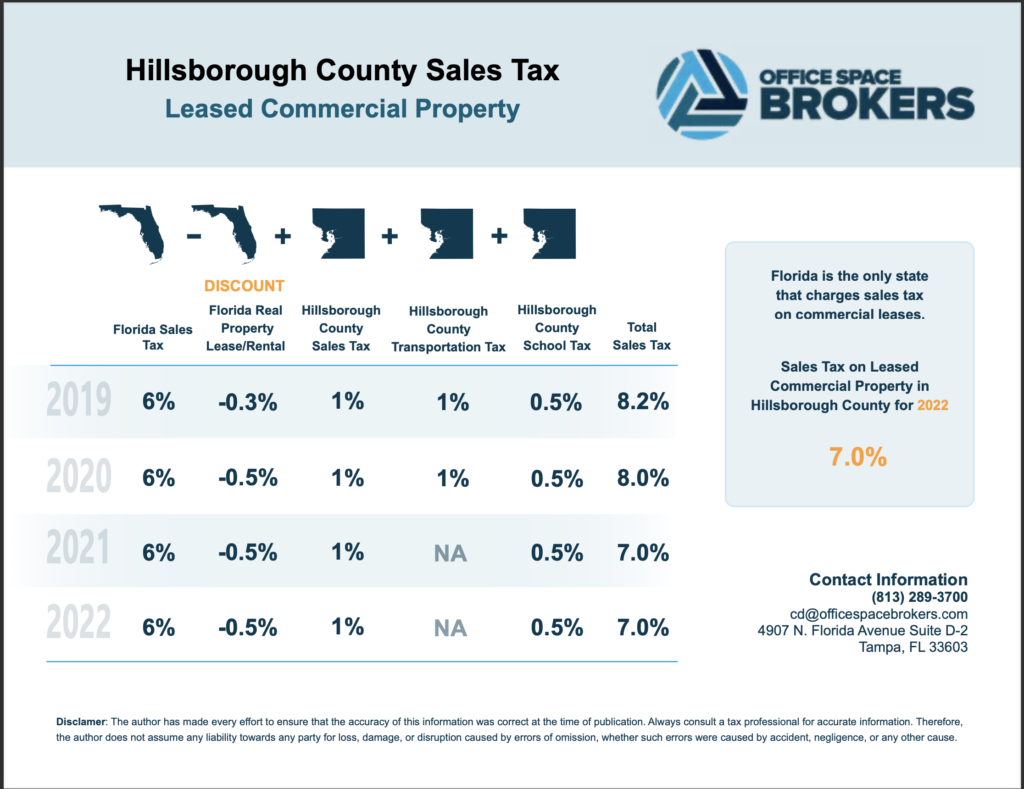

Florida Is The Only State Which Charges Sales Tax On Commercial Leases, The sales tax in florida in 2025 is 6%, which applies to sales, admissions, rentals, and storage. What is the tax rate for federal income taxes for small businesses in.

The Ultimate Guide to Collecting and Paying Sales Tax in Florida, The internal revenue service is piloting a new tax filing service, direct file, during the 2025 filing season to allow eligible taxpayers to file their federal income taxes online, for free,. Your 2025 federal income tax comparison your marginal federal income tax rate your effective federal income tax rate your federal income taxes.

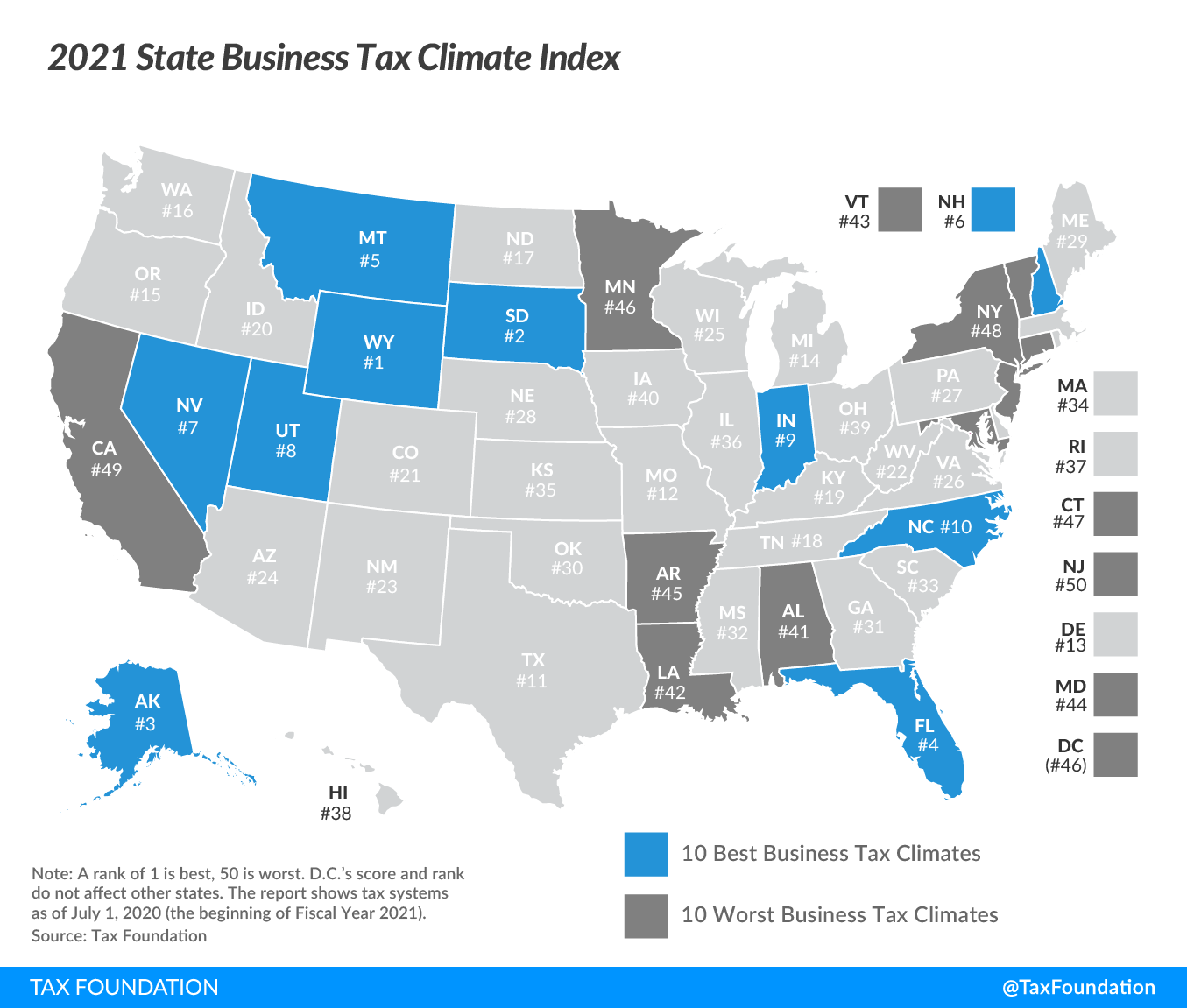

Florida ranks 4 best state for business tax climate Tampa Bay, The federal federal allowance for over 65 years of age married (separate) filer in 2025 is $ 1,550.00. Here are 10 big issues that died during florida's.

Tax Rates to Celebrate Gulfshore Business, Here are 10 big issues that died during florida's. Retirement plan contributions (401 (k), 403 (b), sarsep, and 457 plans):

Florida Tax Laws Gulf Coast International Properties Naples Real, Electricity is taxed at 6.95%,. The florida income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2025.

Florida Legislature Wants To Roll Property Taxes Into State Sales, The florida income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2025. The federal federal allowance for over 65 years of age married (separate) filer in 2025 is $ 1,550.00.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.